SECURITIES AND EXCHANGE COMMISSION

INFORMATION REQUIRED IN PROXY STATEMENT

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the Registrant

þ☑Filed by a Party other than the Registrant

o ☐Check the appropriate box:

| |

o | Preliminary Proxy Statement |

| |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

þ | Definitive Proxy Statement |

| |

o | Definitive Additional Materials |

| |

o | Soliciting Material Pursuant to §240.14a-12 |

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Kaiser Aluminum Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☑ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

| |

o

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

|

| |

(1) | Title of each class of securities to which transaction applies: |

| |

(2) | Aggregate number of securities to which transaction applies: |

| |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) | Proposed maximum aggregate value of transaction: |

| |

o | Fee paid previously with preliminary materials: |

| |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) | Amount previously paid: |

| |

(2) | Form, Schedule or Registration Statement No.: |

LETTER TO OUR STOCKHOLDERS

FROM OUR EXECUTIVE CHAIRMAN, OF THE BOARD AND OUR LEAD INDEPENDENT DIRECTOR

AND,OUR PRESIDENT AND CHIEF EXECUTIVE OFFICER

April 29, 2020

28, 2023

Dear Stockholder:

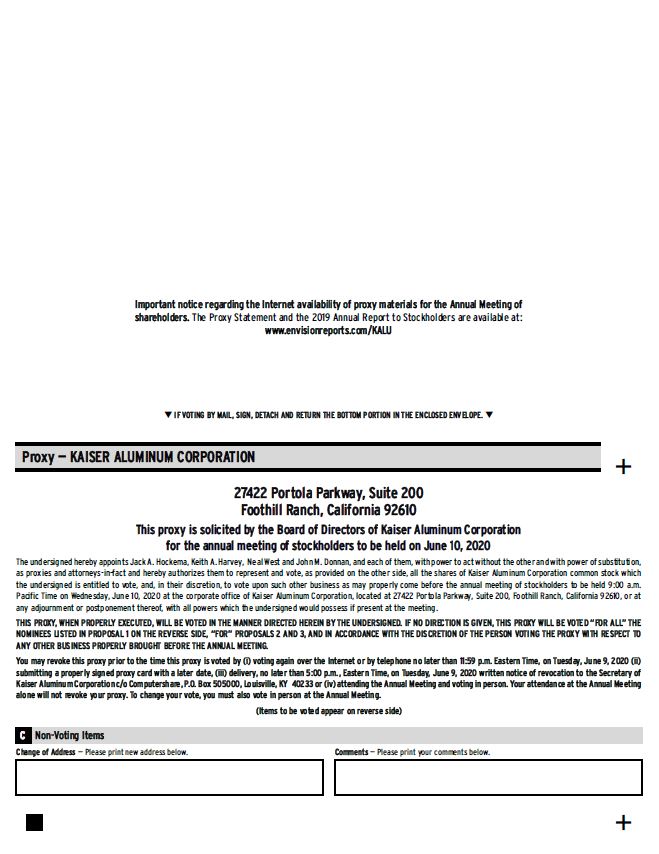

On behalf of our Board of Directors and management team, we thank you for your continued support of Kaiser Aluminum.Aluminum Corporation. It is our pleasure to invite you to attend the Annual Meeting of Kaiser Aluminum CorporationStockholders to be held at the Company’sour corporate office, located at 27422 Portola Parkway,1550 West McEwen Drive, Suite 200, Foothill Ranch, California 92610,500, Franklin, Tennessee, on Wednesday, June 10, 2020,7, 2023, at 9:00 a.m., local time. Central Time. While the Company doeswe do not expect to make a separate presentation, we expect our directors and officers to be present at the Annual Meeting and available to respond to any questions you may have.

As part of our contingency planning regarding novel coronavirus (“COVID-19”), we are preparing for the possibility that the date, time or location of the Annual Meeting may be changed or that the Annual Meeting may be held by means of remote communication (sometimes referred to as a "virtual" meeting). If we take this step, we will announce the decision to do so in advance through a press release and public filing with the Securities and Exchange Commission, and details will be available at www.kaiseraluminum.com.

Your vote is very important to us. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares as promptly as possible. Details of the business to be conducted at the Annual Meeting are included in this proxy statement, which we encourage you to read carefully. You may submit your voting instructions over the Internet or by telephone as indicated on the enclosed proxy card or by completing, signing and dating the enclosed proxy card and returning it by mail in the accompanying envelope. If you plan to attend the Annual Meeting, please review the information on attendance provided on in this proxy statement.

We would like to share with you several areas of particular significance in advance of our Annual Meeting and in connection with our distribution of this proxy statement:

CURRENT ENVIRONMENT

PERFORMANCE HIGHLIGHTS AND BUSINESS STRATEGY

As we prepare the letter to stockholders this year, the COVID-19 pandemic has resulted

We believe 2022 was a pivotal time in significant business and economic uncertainty, challenges and potential opportunities. We do not know how long the pandemic will last, what implications it will have on our business or what type of economic conditions we will experienceKaiser’s evolution as we look forward. However,established the necessary groundwork to position the Company for long-term, sustainable growth amid numerous challenges including unprecedented supply chain disruptions, inflationary cost pressures and historically high labor turnover. While these headwinds negatively affected our financial results in 2022, we do knowanticipate that for more than two decades, our business model, consistentgo-forward strategy and core values have positioned us well for unexpected adversity,focused execution will lead to improved performance as we continue through 2023.

For the full year 2022, we reported net sales of $3.4 billion and we are preparedconversion revenue of $1.4 billion. Our net sales and conversion revenue increased 31% and 24%, respectively, compared to address2021, primarily as a result of our acquisition of Alcoa Warrick LLC (“Warrick”) at the challenges and potential opportunities presentedend of the first quarter 2021 coupled with strength in our aerospace/high strength products. Net sales were partially offset by the pandemic. Our Board is closely overseeing the Company’s initiatives in responding to the COVID-19 pandemicsignificant supply chain challenges we experienced, particularly within our beverage and it continues to focus on the Company’s long-term goals and responsibilities.

The health and safety of our employees are and continue to be our first priority. Our facilities have continued to operate despite shelter-in-place mandates, reflecting their inclusion in the Critical Manufacturing Sector, as definedfood packaging ("Packaging") operations, which were impacted by the U.S. Department of Homeland Security,third quarter 2022 force majeure event at Warrick, and recognition as essential businesses by state and local government authorities. We have implemented steps to protect our employees and limit visitors to our sites and, where possible, our employees are working remotely until we return to normal operations.

Over the past two decades, positioning Kaiser Aluminum as a preferred supplier has been a key tenet of our core values and our competitive strategy. Driven by this guiding principle we have developed strong and deep partnerships with our blue chip customer base, differentiating the Company with quality products and Best-in-Class customer satisfaction. This positions us well at all times, but especially during periods of economic distress when our customers turn to their most trusted and financially secure suppliers. Working in partnership to meet their needs in good times and in bad, we continue to strengthen and solidify these relationships.

Our business model is to be prepared at all times for unexpected economic adversity. We focus on managing for the downturn, and analyzing a number of recession case scenarios is integral to our planning, forecasting, capital investment and capital allocation processes. At every Board meeting, management and our Board review the Company’s liquidity under stress-tested conditions to ensure we can withstand a severe downturn in our served market segments.

In November 2019, we proactively completed two new debt financings. We replaced our previously existing secured revolving credit facility with a new $375 million facility that matures in 2024, and we retired $375 million aggregate principal amount of our 5.875% senior unsecured notes due 2024, issuing $500 million aggregate principal amount of 4.625% senior unsecured notes due 2028. In April 2020, we issued $300 million aggregate principal amount of 6.500% senior unsecured notes due 2025, increasing our total liquidity to approximately $1 billion, after adding net proceeds from the offering to the $688 million of liquidity as of March 31, 2020.

The great recession of 2008-2009 tested our business model. Unlike many other companies at the time, we validated our strategy and continued to focus on execution while tactically responding to changes in market conditions. With strong liquidity, we retained and paid our regular quarterly dividend and continued to proceed with a $100 million strategic capital investment in a state-of-the-art extrusion facility in Kalamazoo, Michigan, which today is a premium quality, low cost producer in its served market segments.

Although the ramifications and impact of the COVID-19 pandemic may be dramatically different than the economic disruption in 2008-2009, we are confident that our strong liquidity, our preferred supplier position and our track record for efficient execution of our strategy will enable us to address challenges and opportunities that come from this economic crisis.

We are providing an essential service to our customers and doing it in a way that reflects greatly on the proud history of Kaiser Aluminum. Working as a strong team, our managers are focused on the health and safety of our workforce, meeting our customers' needs, managing costs and ensuring we continue to adjust to fluid circumstances. Thank you to all the employees at Kaiser Aluminum for their dedication, loyalty and hard work.

2019 PERFORMANCE HIGHLIGHTS

Looking back, 2019 was a solid year as we achieved several financial milestones, including record value added revenue, adjusted EBITDA, adjusted net income and adjusted earnings per diluted share. We achieved these results despite planned

and unplanned downtimemulti-week outage at our Trentwood facility

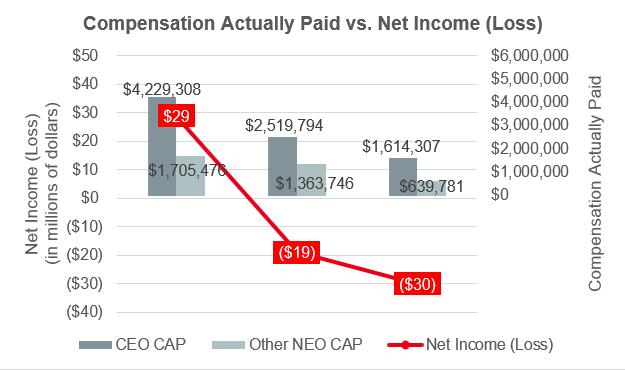

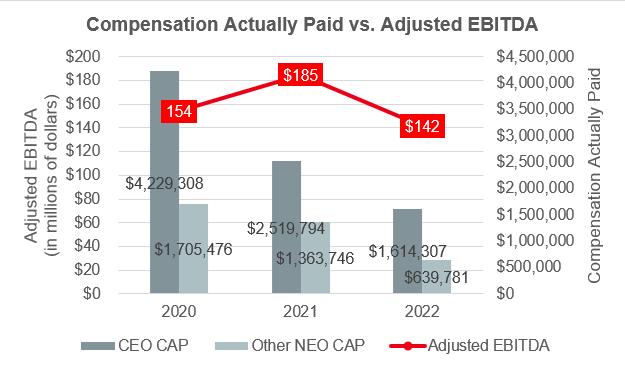

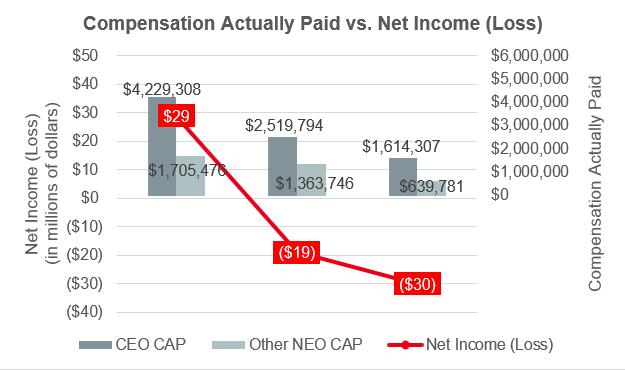

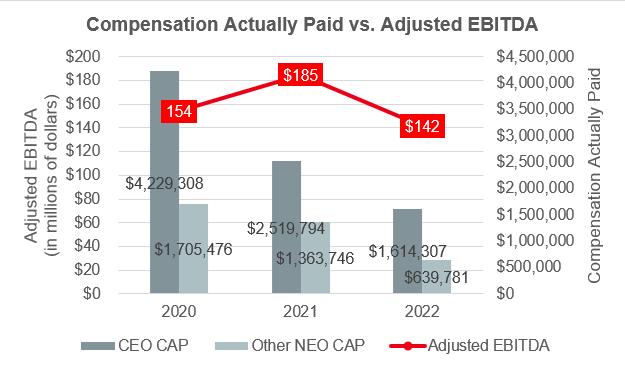

to refurbish our heavy gauge stretcher. We reported a net loss of $30 million and adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”) of $142 million. Net loss increased by $11.1 million and Adjusted EBITDA declined by $43 million compared to 2021 predominantly due to these supply chain issues coupled with significantly higher inflationary costs. See Appendix A to this Proxy Statement for reconciliations of measures from generally accepted accounting principles (“GAAP”) to non GAAP measures.

We are diligently working to offset inflationary pressures through pricing actions, cost reduction efforts and efficiency improvement projects. While our efforts will take time to manifest, we are confident in Spokane, Washingtonour ability to execute given our solid market position. We are a key supplier in diverse end markets (aerospace/high strength, packaging, automotive and general industrial) with strong secular growth characteristics, strong customer relationships and multi-year contracts with key

1

strategic partners. Demand trends supporting secular demand growth are largely sustainability-driven including the first halfconversion from plastic to aluminum beverage and food packaging and light weighting in applications such as aircraft and transportation to increase fuel efficiency. Additionally, we believe we are poised to benefit from strong secular growth in global passenger air travel and North American industrial demand given the continued trend of 2019,re-shoring for domestic supply.

In our Packaging operations, we completed the transformational acquisition of Warrick on March 31, 2021, marking our strategic re-entry into the resurging North American aluminum packaging market. In response to the supply chain issues that negatively affected our performance in 2022, we successfully diversified our supply base and refined our strategy to better capitalize on the long-term growth opportunity ahead of us. After augmenting Warrick's existing management team with several seasoned Kaiser leadership members, we remain highly focused on accelerating the integration of Warrick into our operating system. Further, we made solid progress working with customers of our Packaging operations to negotiate improvements to commodity price adjustments to mitigate the impact of the General Motors strikeinflationary and volatile commodity costs on our business and improve our margin profile. We are also prioritizing investments for growth through our roll coat capacity expansion project, which is expected to convert approximately 25% of our current output to higher margin coated products by mid-to-late 2024 and drive margin improvement. We remain very excited about Warrick’s long-term potential and competitive positioning in the second halfpackaging market. In addition, our team once again delivered strong safety performance in 2022 even as we experienced high turnover.

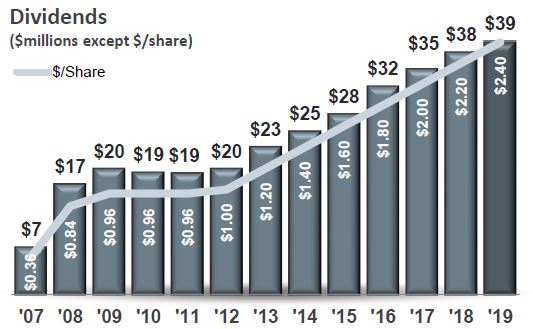

We remain committed to supporting the growth of our business in 2023 while concurrently continuing our track record of returning cash to stockholders through quarterly cash dividends, which we have paid for 16 consecutive years without reduction or suspension. In April 2023, our Board declared a quarterly dividend of $0.77 per share, underscoring the year,confidence our Board and reduced salesmanagement have in our long-term strategy for profitable growth and efficiency relatedincreasing stockholder value. Further, we have a strong projected capital expenditure budget of approximately $170 to the significant number$190 million for 2023, 60% of automotive model changeovers in 2019.

In late 2019, we also finalized a new labor agreement that extends through 2025 for our two largest facilities in Spokane, Washington and Newark, Ohio, a testamentwhich is dedicated to our relationship and partnership with the United Steel, Paper and Foresting, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union, AFL-CIO, CLC (the “USW”).

In addition, with continued confidence in the long-term outlook forgrowth initiatives, including our business, the Board approved a 12% increase in the quarterly dividend to $0.67 per share, up from the 9% increase in early 2019, marking the ninth consecutive year we have increased our quarterly dividend.

With a view towards the longer-term demand growth of heat treat plate for applications in our aerospace and general engineering end markets, we also announced a $375 million, multi-yearroll coat expansion project at

Warrick and other projects to improve our

Trentwood facilitycapacity, quality and sustainability.

CORPORATE SUSTAINABILITY

We manage our business for long-term success in a manner that will provide increased capacity, redundancy, efficiencyis economically, environmentally and operational security for key bottleneck operationssocially responsible. We believe our products are part of the carbon solution and efforts to limit global warming to below a 2° C threshold by 2050 given aluminum is an infinitely recyclable, sustainable material. We strive to optimize the use of recycled or scrap aluminum and invest in the Trentwood facility's process flow. We willour business to increase operating efficiencies as we continue to monitor market conditionsidentify new initiatives to determinereduce the timingcarbon intensity of our products and actively evaluate new technologies as they become available.

In 2022, we continued to build on the various modules contained within this strategic project includingcore elements of our sustainability initiatives and advance our environmental, social and governance (“ESG”) disclosures and programming. Since 2021, we have established greenhouse gas ("GHG") emissions intensity reduction goals and further aligned our disclosures with both the initial $145 million investmentSustainability Accounting Standards Board (“SASB”) framework and Task Force on Climate-Related Financial Disclosures (“TCFD”). Additionally, we expanded environmental disclosures to include operational metrics for Warrick, water program case studies for Trentwood, energy consumption, waste information and sustainability goals and highlights focused on GHG emissions intensity, reduction goals, plans and progress. Further, we enhanced disclosures focused on cybersecurity, the Kaiser Aluminum Women’s Leadership Program and our corporate ESG-related policies. We also continued our participation in a new plate stretcher.

charitable outreach, as well as contributions to and sponsorships of community driven organizations and events. We remain committed to further advancing our initiatives in 2023 and beyond.

BOARD OVERSIGHT OF STRATEGY

AND STOCKHOLDER ENGAGEMENT

Our Board remains actively focused on overseeing the Company’sour business strategies, risk management, talent development, succession planning and the development and execution of our long-term strategy, including with respect to ESG matters. By expanding our ESG Committee charter, our Board supports ESG engagement as we continue our focus on climate-related risks, opportunities and disclosures, further supporting the Company’sstrategic positioning of our company as a responsible and resilient organization positioned for long-term strategy. In addition to ongoing programs embedded withingrowth and profitability.

We continued proactively engaging with all our enterprise risk management programs, additional areas of focusstakeholders in 2022, including environmental socialgroups, state and governance matters, are reviewed by local government agencies, stockholders, industry and business peers, our employees and their representatives to advance our

2

management withand Board’s understanding of opportunities, issues, concerns and challenges towards collective improvement for a more sustainable future. By providing oversight of our ESG programming and initiatives, our Board throughout the year.

By focusing on our long-term outlook,is well informed and equipped to engage with management as we are best able to support our common goal of creating enduring value in our Company and for our stockholders. We contribute to management’s strategic plan by engaging the Company's senior

management in robust discussions about the Company’s overall strategy, priorities for its businesses, capital allocation, risk assessmentevaluate risks and opportunities for

Kaiser’s long-term sustainability and value creation for all stakeholders while ensuring consistency with the Company’s culture and corporate values.

In addition, we continued long-term growth through our regularly scheduled meetings, including a dedicated annual strategic planning session, and throughout the year.

CORPORATE GOVERNANCE AND STOCKHOLDER ENGAGEMENT

We believe effective governance means ongoing and thoughtful evaluation of our governance structure, including our Board and Board committees, and constructiveextensive stockholder engagement on evolving environmental, social and governance issues. We conduct an annual corporate governance survey of management and non-management employeesprogram in order to monitor the internal perception around a broad range of topics including the Company's control environment, risk mitigation and management, the use of technology, Company values and the overall “tone at the top.”

Our Board values the feedback and insights gained from frequent engagement with our stockholders. In 2019, in addition to interactions regarding our financial performance, management engaged2022 by engaging with stockholders representing approximately 60%50% of our outstanding shares on a variety of matters relating to our long-term business strategy and performance, corporate governance,operations, capital allocation, strategic acquisition of Warrick, executive leadership succession, executive compensation and corporate responsibility.ESG matters. We are committed to including the perspective of our stockholders’ perspectivesstockholders in boardroom discussions and we believe that regular engagement with our stockholders is necessary in order to ensure thoughtful and informed consideration of those matters. We look forward to continuing to engage in productive dialogue with our stockholders and other stakeholders in 20202023 and beyond.

BOARD REFRESHMENT

CORPORATE GOVERNANCE AND SUCCESSION PLANNING

OurSTAKEHOLDER ENGAGEMENT

At Kaiser Aluminum, we believe effective corporate governance means ongoing and thoughtful evaluation of our governance structure, including our Board recognizesand Board committees, with a strong emphasis on the importance of integrity, competence and is committeddiversity to board refreshmentleadership, character and succession planning that ensuresculture. We maintain a robust and multi-tiered Board and committee annual assessment process including an annual corporate governance survey of management and non-management employees to measure internal perceptions on a broad range of topics, including our directors possess a composite set of skills, experienceculture, corporate values and qualifications necessary to successfully review, challenge and help shape the Company’s strategic direction. We have a mandatory retirement policy that provides that unless otherwise approved by our Board, no individual may be nominated for election or re-election as a director if the individual would be age 75 or older at the time the term would begin. Our Nominating and Corporate Governance Committee also regularly evaluates the size and compositioneffectiveness of our Board.

In 2018 and 2019, we added four new highly qualified independent directors, including Emily Liggett, Teresa M. Sebastian, Donald J. Stebbins, and Leo Gerard, to our Board. Ms. Liggett was President and Chief Executive Officer of Nova Torque, Inc. and has management and board experience in manufacturing, strategy, operations, product development, sales, marketing and business development. Ms. Sebastian is President and Chief Executive Officer of The Dominion Asset Group, was previously the Senior Vice President, General Counsel, Corporate Secretary and internal audit executive leader of Darden Restaurants, Inc., and is experienced in finance, mergers and acquisitions, global transactions, internal audit, governance, enterprise risk, and compliance. Mr. Stebbins is the former President and Chief Executive Officer of Superior Industries International, Inc. and has extensive automotive industry experience, as well as experience in international business, manufacturing, sales, product innovation and development, accounting and finance, and mergers and acquisitions. Mr. Gerard was the International President of the USW and has extensive labor and industry experience.

In addition, we have reduced our average Board tenure from 12.0 years at the 2018 meeting of stockholders to 8.8 years at the 2020 meeting of stockholders.

training.

BOARD COMPOSITION

Our Board is highly independent, engaged and diverse in perspectives and backgrounds as reflected by its composition, which is currently 92%82% independent, 35% gender24% ethnically diverse and 17% ethnically18% gender diverse. This structure underscores the Board’s belief that the Company is best served when it cancommitment to draw upon members with a varietyunique set of perspectivesskills and experiences that we believe are highly complementary to exercise strong and experienced oversight. We have aour company strategies. Our policy of encouragingencourages diversity of gender, ethnicity, age and background, as well as a range of tenures among our director nomineeson the Board, to ensure both continuity and fresh perspectives on our Board.

CORPORATE SUSTAINABILITY MATTERS

WhileBoard and to enhance thoughtful, cognitive diversity.

BOARD REFRESHMENT AND SUCCESSION PLANNING

Our Board maintains a continued focus on identifying critical board skills needed to support our corporate strategy and succession planning process. The ESG Committee of our Board oversees, among other things, the COVID-19 pandemicsuccession planning for our executive officers, other than our CEO, whose succession is discussed routinely during Board executive sessions, and the leadership and development training of key employees with the potential to succeed our executive officers, including the progression and development of these key employees. Senior management, including our CEO, also meet monthly to review and set strategy and monitor performance metrics, including the evaluation and review of internal and external diverse candidates, internal promotions, our various talent development programs and platforms, anticipated retirements and succession planning to ensure the identification and development of the next wave of qualified leaders. Further, the Nominating and Corporate Governance Committee plans for the orderly succession of our Lead Independent Director and of the Chairs of our Board committees, providing for the identification of potential successors, their development and the transition of responsibilities. As a result of the management and execution of our Board's succession plans, a leadership transition of our Board's Nominating and Corporate Governance Committee occurred in March 2023 and the role of our Lead Independent Director will be transitioned to Michael C. Arnold following our 2023 Annual Meeting of Stockholders.

We also have an impacta Director Designation Agreement with the United Steelworkers (“USW”) pursuant to which the USW has the right to nominate at least 40% of our Board members . We believe this agreement has facilitated a constructive dialogue and collaboration with the USW on business conditionsmatters important to the USW, its members and the Company, including our Board’s skill matrix, Board succession, planning and future nominations.

SUMMARY

Our corporate values of being a preferred investment, preferred supplier, preferred employer, preferred customer, and valued corporate citizen serve as the foundation of our strategic initiatives. We remain intently focused on continuing to

3

pursue cost reductions in our operations, as well as improving efficiencies and implementing commercial actions to increase our commitmentprofitability and margins. We believe the strategy we have in place will lead to the sustainability ofimproved performance in 2023 and beyond. While our businessefforts will take time to manifest fully, we are confident in our ability to execute given our solid market position as a key supplier, focus on diverse end markets with strong secular growth characteristics, deep customer relationships and creating long-term shareholder value for our stakeholders remains a critical and an integral part of our corporate values.multi-year contracts with strategic partners. We will continue to manage our business for long-term success in a manner that we believe is economically, environmentally and socially responsible. Our interim 2019 Sustainability Report captures the highlightsresponsible as a good corporate citizen and steward of capital. We thank our sustainability culture and initiatives that we continue to develop as good stewards ofstockholders, our environment and resources.

To all of our stakeholders - customers, suppliers, investors, employees and the communities in which we operate - your contribution and support have made Kaiser Aluminum what it is today - a highly differentiated, well-respected leader in our industry - and a company well positioned for the future. We look forward to continuing to deliver value totheir families, our customers, shareholdersour suppliers and communities. We are gratefulour other stakeholders for yourtheir ongoing commitment to and support of Kaiser Aluminum and of our Board.

Aluminum.

|

| | | |

|

|

|

|

|

|

| |

|

|

Keith A. Harvey |

| Jack A. Hockema |

| Alfred E. Osborne, Jr., Ph.D. |

President and Chief Executive Officer and |

| Executive Chairman of the Board |

| Lead Independent Director |

4

Kaiser Aluminum Corporation

27422 Portola Parkway,1550 West McEwen Drive, Suite 200

Foothill Ranch, CA 92610-2831

500Franklin, Tennessee 37067

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

JUNE 10, 2020

June 7, 2023NOTICE IS HEREBY GIVEN that the 20202023 Annual Meeting of Stockholders (the "Annual Meeting") of Kaiser Aluminum Corporation will be held at the company's corporate office, located at 27422 Portola Parkway,1550 West McEwen Drive, Suite 200, Foothill Ranch, California 92610,500, Franklin, Tennessee, on

Wednesday,, June 10, 2020,7, 2023, at 9:00 a.m., local time,Central Time, for the following purposes:(1)To elect four members to our board of directors for three-year terms to expire at our 2026 annual meeting of stockholders;

(2)To approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in the accompanying Proxy Statement;

| |

(1) | (3)To make a recommendation, on a non-binding, advisory basis, as to the frequency of future advisory votes on the compensation of our named executive officers; (4)To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2023; and (5)To elect three members to our board of directors for three-year terms to expire at our 2023 annual meeting of stockholders;

|

| |

(2) | To approve, on a non-binding, advisory basis, the compensation of our named executives officers as disclosed in the accompanying Proxy Statement; |

| |

(3) | To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2020; and

|

| |

(4) | To consider such other business as may properly come before the Annual Meeting or any adjournments thereof. |

As part of our contingency planning regarding novel coronavirus (COVID-19), we are preparing for the possibility that the date, time or location of the Annual Meeting may be changed or that the Annual Meeting may be held by means of remote communication (sometimes referred to as a "virtual" meeting). If we take this step, we will announce the decision to do so in advance through a press release and public filing with the Securities and Exchange Commission, and details will be available at www.kaiseraluminum.com.any adjournments thereof.

Information concerning the matters to be acted upon at the Annual Meeting is set forth in the accompanying Proxy Statement. This notice and the accompanying proxy materials are being mailed or made available to stockholders on or about April 29, 2020.

28, 2023.The close of business on

April 17, 202012, 2023 has been fixed as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournments thereof.

We urge stockholders to vote by proxy by submitting voting instructions

over the Internet or by telephone as indicated on the enclosed proxy card or bycompleting, signing and dating the enclosed proxy card and returning it by mailin the accompanying envelope, which does not require postage if mailed in theUnited States.

|

| |

| By Order of the Board of Directors |

| |

| John M. Donnan |

| Executive Vice President, - Legal,Chief Administrative |

| ComplianceOfficer and Human ResourcesGeneral Counsel |

|

|

April 29, 2020

|

|

Foothill Ranch, CaliforniaApril 28, 2023 |

|

Franklin, Tennessee |

|

PROPOSALS AND BOARD RECOMMENDATIONS

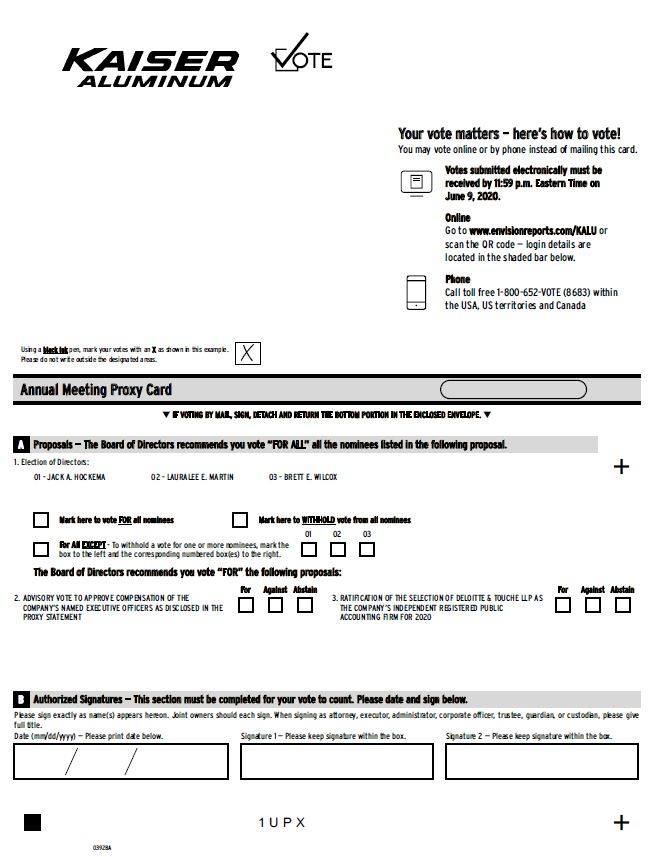

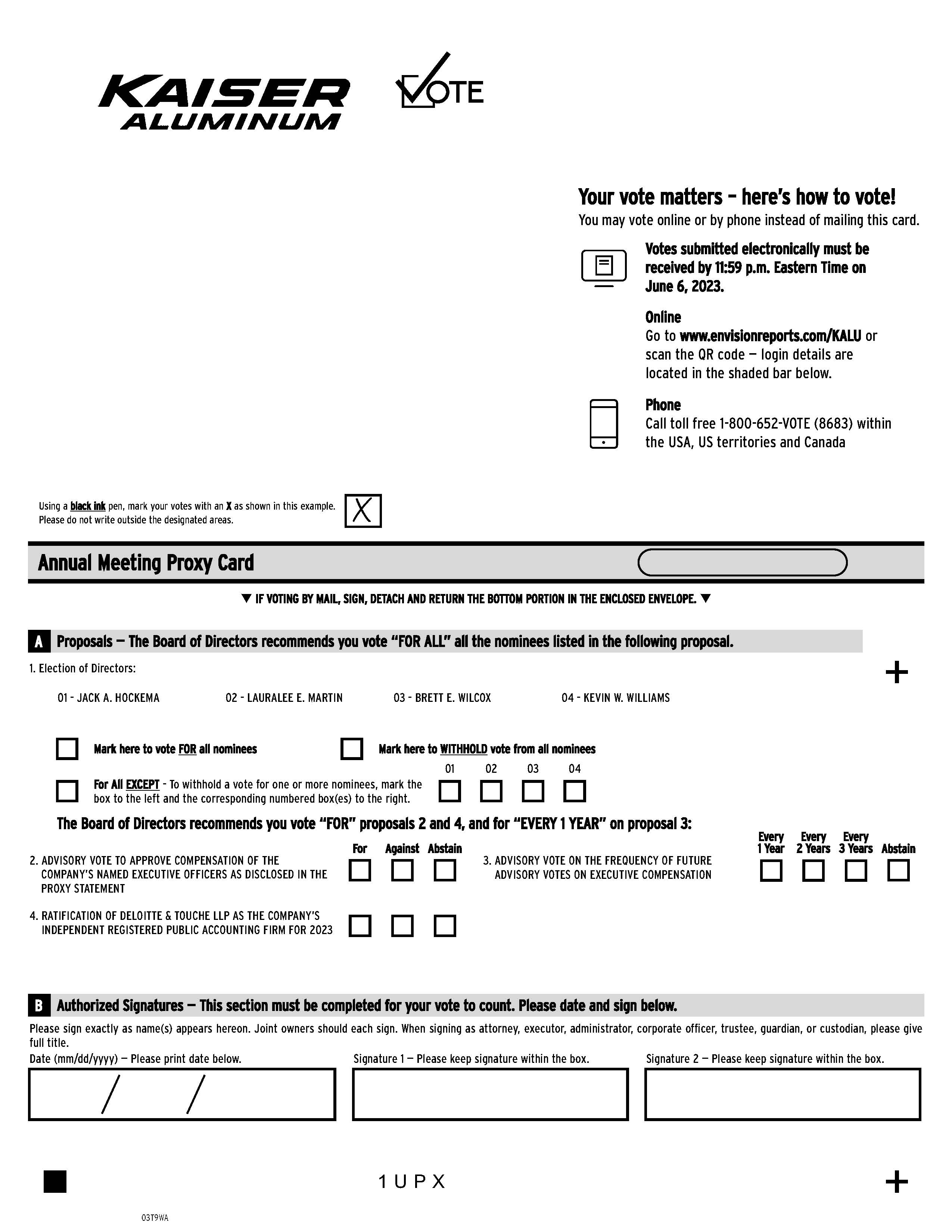

Proposal 1 - Election of Directors

The board of directors recommends a vote "FOR ALL" of the persons

nominated by the board of directors.

Additional information about each director and his or her qualifications may be found beginning on page 5.

|

| | | | | | |

| Name | Age | Director Since | Primary Occupation | Independent | Committee Membership |

| Jack A. Hockema | 73 | 2001 | Chief Executive Officer ("CEO") and Chairman of the Board, Kaiser Aluminum Corporation | | Ÿ | Executive (Chair) |

| Lauralee E. Martin | 69 | 2010 | Retired Chief Executive Officer and President, HCP, Inc. | ü | Ÿ | Audit (Chair) |

| Ÿ | Compensation |

| Ÿ | Executive |

| Ÿ | Talent Development |

| Brett E. Wilcox | 66 | 2006 | Chief Executive Officer, Cvictus | ü | Ÿ | Audit |

| Ÿ | Compensation |

| Ÿ | Executive |

| Ÿ | Talent Development (Chair) |

| | | | | | |

Name | Age | Director Since | Primary Occupation | Independent | Committee Membership |

Jack A. Hockema | 76 | October 2001 | Executive Chairman of the Board |

| | Executive (Chair) |

Lauralee E. Martin | 72 | September 2010 | Retired Chief Executive Officer and President, HCP, Inc. | | | Audit (Chair) |

| Compensation |

| Executive |

| ESG |

Brett E. Wilcox | 69 | July 2006 | Chief Executive Officer, Cvictus Inc. | | | Audit |

| Compensation |

| Executive |

| ESG (Chair) |

Kevin W. Williams | 61 | September 2021 | President and Chief Executive Officer, GAA Manufacturing and Supply Chain Management | | | Audit |

• | Compensation |

|

|

Proposal 2 - Advisory Vote to ApprovedApprove Named Executive Officer Compensation

The board of directors recommends a vote "FOR" the approval, on a non-binding, advisory basis, of the compensation of our named executive officers as disclosed in this Proxy Statement.

Additional information about executive compensation may be found beginning on page 13.

14.Proposal 3 - Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation

The board of directors recommends a vote for the option of “EVERY 1 YEAR” as the frequency of future advisory votes on the compensation of our named executive officers.

Additional information about the named executive officer compensation advisory votes may be found beginning on page 17.

Proposal 4 - Ratification of Appointment of Independent Registered Public Accounting Firm

The board of directors recommends a vote "FOR" the ratification of the audit committee's selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2020.

2023.Additional information about the independent registered public accounting firm may be found beginning on page 16.

17.

With consistent execution ofWe believe 2022 was pivotal in our strategic priorities,evolution as we have achieved a strong, industry-leading business, evidenced again in 2019 by excellent resultslaid the necessary groundwork to position our company for long-term, sustainable growth despite the numerous challenges we encountered, including unprecedented supply chain disruptions, inflationary cost pressures and a number of important milestones, despite formidable headwinds.historically high labor turnover, which negatively impacted our financial performance. This summary highlights information contained elsewhere in this Proxy Statement. This summaryStatement but does not contain all of the information that you should consider. We encourage you to read the entire Proxy Statement for more information about these topics prior to voting.

|

| | |

COMPANY OVERVIEW | Ÿ | Leading North American producer of highly engineered aluminum mill products that are part of the carbon solution |

Ÿ | Focus on demanding applications for aerospace, automotive andpackaging, general industrial end-marketsand automotive end use markets |

Ÿ | Fundamental part ofIntegral “pass-through” business model is mitigatingto mitigate the impact of aluminum price volatility of aluminum and other alloys |

Ÿ | Long-standing customer relationships -with blue chip customers – original equipment manufacturers, tier 1 suppliers, and metal service centers and beverage and food packaging manufacturers |

Ÿ | DifferentiatedDifferentiation through broadsuperior product offeringattributes and “Best in Class” customer satisfaction |

Ÿ | Significant investment in talent development throughout companyCommitment to sustainable practices remains a critical and integral part of corporate strategy |

| | |

2022 PERFORMANCE HIGHLIGHTS | | Managed significant supply chain disruptions, integration challenges, inflationary cost pressure and historically high labor turnover |

CYCLICALITY STRATEGY | Ÿ | Always be prepared for unexpected economic adversityFocused on cost reduction efforts through ongoing efforts to improve efficiencies as operations stabilize |

Ÿ | Retain strong liquidityInitiated commercial actions to weather a deep recession - $688 million as of March 31, 2020address inflationary and volatile metal cost |

Ÿ | Maintain conservative leverage - 0.7x net debt : LTM Adjusted EBTIDA as of March 31, 2020Prioritized investments in our growth through roll coat capacity expansion project at our Warrick facility |

Ÿ | Establish and maintain a strong preferred supplier partnership positionRefined Warrick strategy with commitment to support growth in our Packaging business |

Ÿ | Flex costs in response to changes in business activity levelPositioned company for strong future growth |

| | |

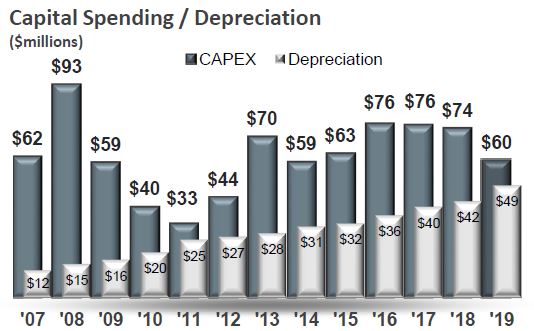

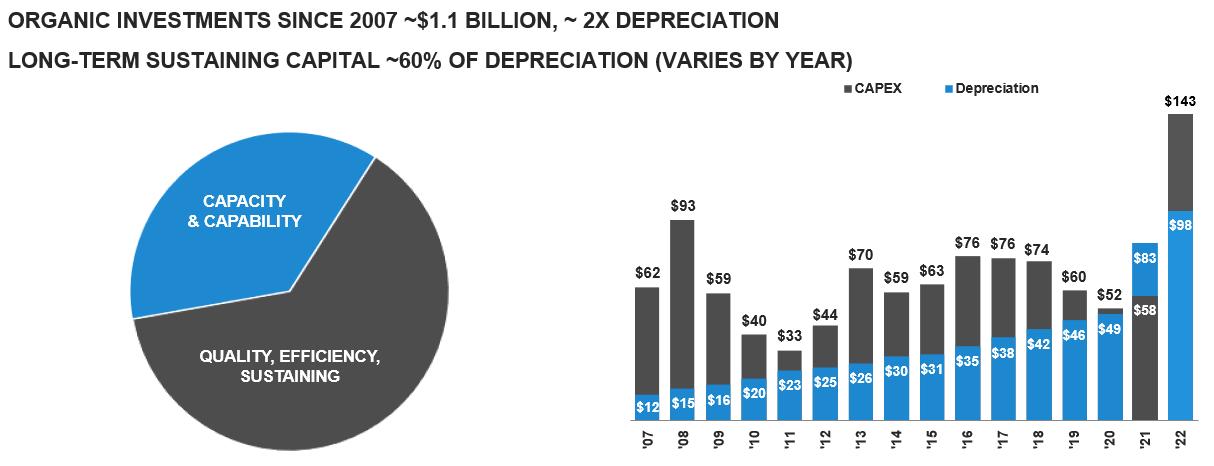

PERFORMANCE HIGHLIGHTS | Ÿ | Achieved key cost position with plant & equipment investments at 2x rate of depreciation |

Ÿ | Maintained financial strength through business cycle, steadily increasing quarterly dividends |

Ÿ | Invested over $800 million in the business since 2007 (~2x depreciation) |

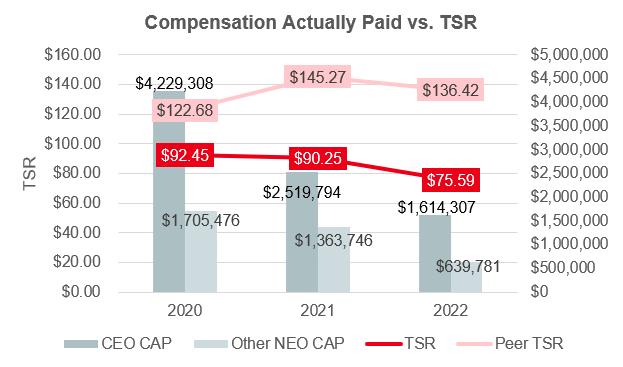

Ÿ | Returned over $750 million to stockholders since 2007 |

Ÿ | Solid total stockholder return ("TSR") (outperformed S&P 600 Materials Index for the last 1-, 3- and 5-year periods) with less volatility than many other industry participants |

| | |

2019 PERFORMANCE | Ÿ | Excellent resultsstrong safety performance despite significant headwinds, including planned and unplanned downtown at Trentwood, the impact of the General Motors strike, and reduced sales and inefficiencies related to the significant number of automotive model changeovers |

Ÿ | Increased liquidity and extended debt maturity dates with a new $375 million revolving credit facility that matures in 2024 and 4.625% senior notes in the aggregate principal of $500 million |

Ÿ | Successfully negotiated a new five-year USW master labor agreementhistorically high turnover rates |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Shipments | | Net Sales | | Net Loss (1) | | Adjusted Net Loss (2) | | Conversion Revenue (2) | | Adjusted EBITDA (2) | | Net Loss Per Diluted Share (1) | | Adjusted Loss Per Diluted Share (2) |

| | | | | | | | | | | | | | |

1.3 | | $3.4 | | $29.6 | | $8.7 | | $1.4 | | $141.9 | | $1.86 | | $0.55 |

| | | | | | | | | | | | | | |

Billion lbs | | Billion | | Million | | Million | | Billion | | Million | | | | |

_____________

(1)Our results reflected significant supply chain issues specifically related to magnesium and molten metal supply at our Warrick facility and reduced packaging and plate shipments in the third quarter 2022, due to the magnesium related force majeure coupled with the planned outage at our Trentwood facility. In addition, higher inflationary driven costs during the year, which we aggressively attempted to offset through pricing actions, cost reduction efforts and efficiency improvement projects, further affected results.

|

| | | | | | | | | | | | | | |

| | | | | | | RECORD | | RECORD | | RECORD | | | | RECORD |

| Shipments | | Net Sales | | Net Income | | Adjusted Net Income* | | Value Added Revenue* | | Adjusted EBITDA* | | Earnings Per Share | | Adjusted Earnings Per Share* |

| | | | | | | | | | | | | | | |

| 625 | | $1,514 | | $62 | | $111 | | $856 | | $213 | | $3.83 | | $6.85 |

| | | | | | | | | | | | | | | |

| Million lbs | | Million | | Million | | Million | | Million | | Million | | | | |

______________

*See Appendix A to this Proxy Statement for reconciliations of measures from generally accepted accounting principles (“GAAP”)GAAP to non-GAAP.non GAAP. While our use of terms such as earnings before interest, tax, depreciation and amortization (“EBITDA”)EBITDA, “adjusted” or “adjusted”"Conversion Revenue" are not intended to be (and should not be relied on) in lieu of the comparable captioncaptions under GAAP to which it isthese metrics are reconciled, those terms are intended to provide greater clarity of the impact of certain material items on the GAAP measure and are not intended to imply those terms should be excluded.

i

| | | |

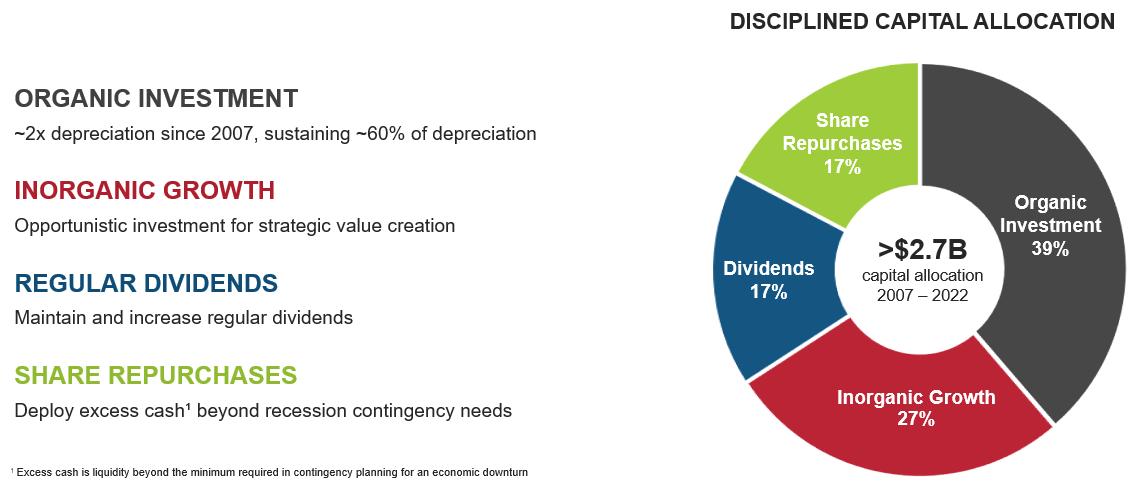

BALANCED CAPITAL ALLOCATION PRIORITIES

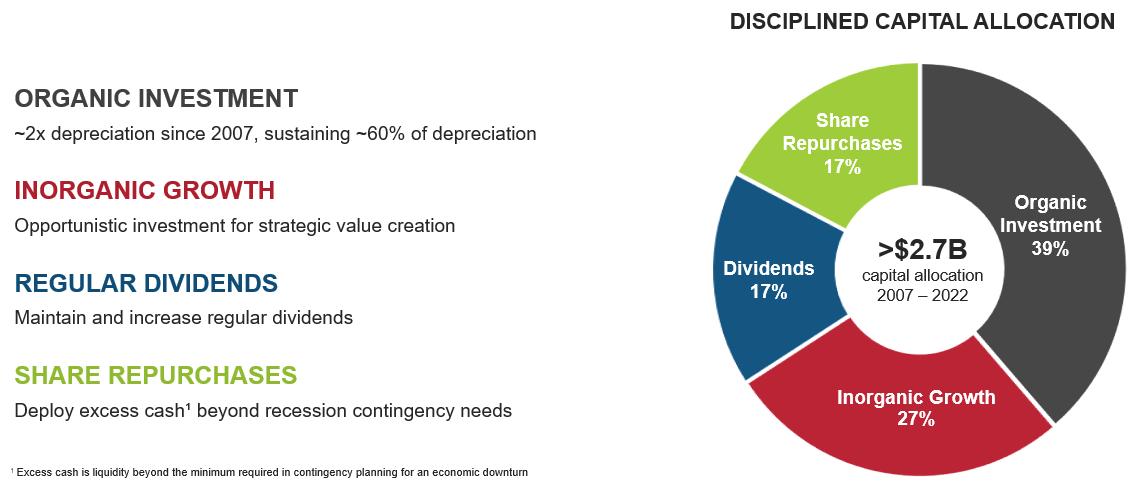

| | Organic Investments |

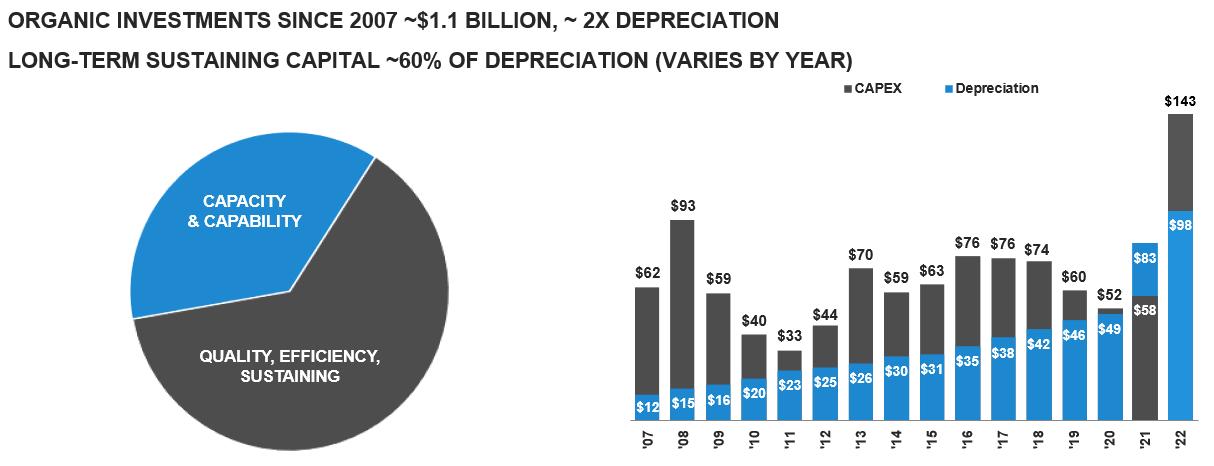

| | Investments of approximately $1.1 billion in the business since 2007 (~2x depreciation) |

| | Long-term sustaining capital of ~60% of depreciation (varies by year) |

| Inorganic Growth |

| | Opportunistic investment for strategic value creation |

| Regular Dividends |

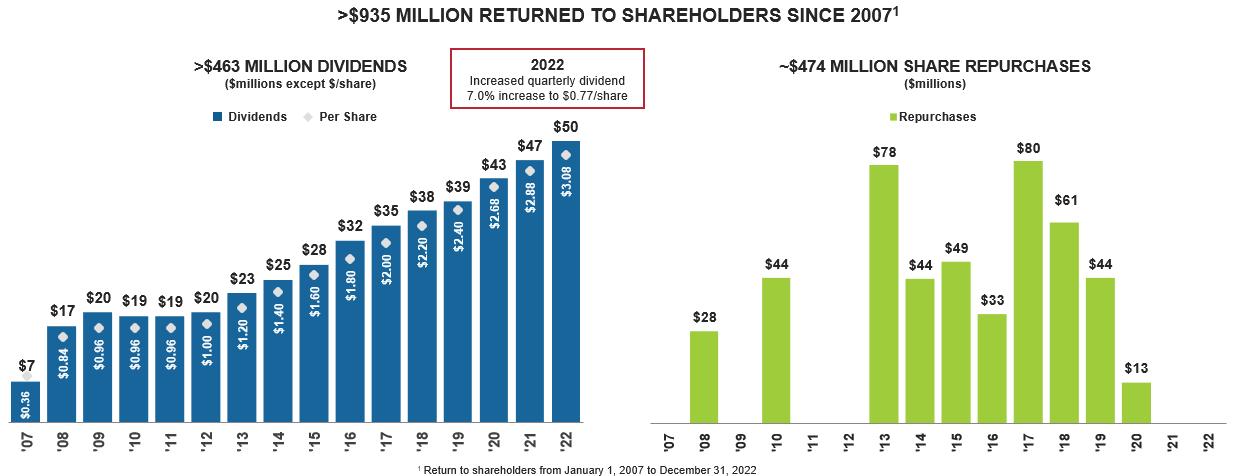

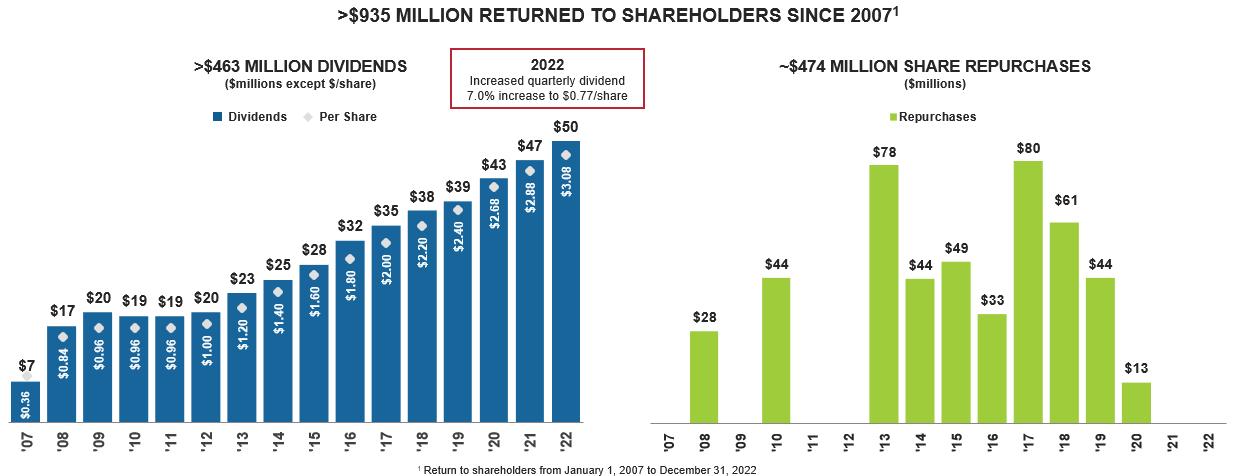

| | >$463 million returned to stockholders since 2007 |

| Share Repurchases |

| | Deployed excess cash beyond recession contingency needs through share repurchases |

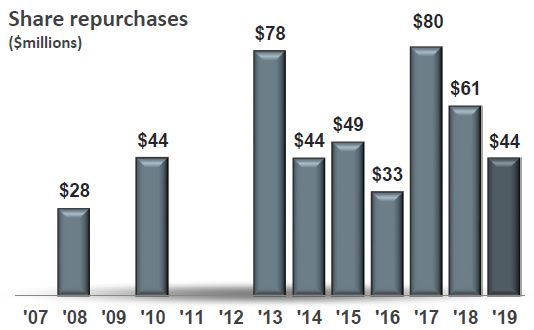

| ~$474 million returned to stockholders through share repurchases since 2007 |

| | |

BOARD OF DIRECTORS | Ÿ | Diverse and highly independent Board |

Ÿ | Ongoing commitment to board refreshment - four highly qualified50% of directors added since 2018have a tenure of less than five years |

Ÿ | Robust and multi-tiered Board and Committee annual assessment process |

Ÿ | Use of internal resources and/or third party to facilitate Board and Committee evaluations |

Ÿ | Continuing focus on identifying critical skills needed to support execution of company strategy and board succession planning |

Ÿ | United Steelworkers ("USW") has right to nominate 40% of our Board members |

Ÿ | StrongContinued strong support for continued proactive and effective stockholder engagement (>(approximately 50% annually) |

| Rigorous director nomination process, including directors nominated by USW under our Director Designation Agreement |

|

| | |

ESG HIGHLIGHTS | | On track to meet our goals to reduce our total Scope 1 and 2 emissions intensity by 20%, Scope 3 estimated emissions intensity by 35%, and Scope 1, 2 and 3 estimated emissions intensity by 30%, compared, in each case, to 2019 CAPITAL ALLOCATION | Ÿ | Consistent capital allocation strategy focused on organic growth, external growth and returning cash to stockholders through dividends and share repurchaseslevels by 2030 |

Ÿ | Continued investmentFurthered commitment to further manufacturing efficiency, quality and capacitytransparent reporting on climate risk management by publishing our inaugural TCFD-aligned report in March 2023 |

Ÿ | Increased quarterly dividend for the 9th consecutive year |

Transformational project to enable Warrick to source electricity from a utility with cleaner grid factor and access to renewable energy |

| | | | | | Continued diversification of Warrick's primary aluminum supplies to sources with lower carbon footprints |

| CONSISTENT CAPITAL ALLOCATION STRATEGY | Continued optimization of our use of recycled and scrap aluminum, which saves more than 90% of the energy generally required by primary aluminum production |

| | | Cash deployment track record | Maintained strong safety and quality performance in 2022 despite historically high turnover rate |

| | Ÿ | Invested >$800M in the business since 2007 (~2x depreciation) | Launched Kaiser Aluminum Women's Leadership Program |

| | Ÿ | Returned >$750M to stockholders since 2007 | |

| | | Ÿ | Dividends increased each year since 2011 | |

| | | Ÿ | ~6.7 million shares repurchased at an average price of $69.34 | |

| | | | Increased transparency by making our EEO-1 report publicly available |

|

| | |

ENVIRONMENT & SUSTAINABILITY | Ÿ | Sustainability is an integral part of our corporate values |

Ÿ | Our business is managed for long-term success in a manner that is economically, environmentally and socially responsible |

Ÿ | Our products are part of the carbon solution, facilitating light weighting and increased fuel efficiency |

Ÿ | Aluminum is infinitely recyclable and we have continued to increase our use of recycled scrap |

Ÿ | Our continued investments increasing our manufacturing efficiency reduce our environmental impact and the environmental impact of our customers |

Ÿ | Published inaugural Corporate Sustainability Report in early 2019 and interim Corporate Sustainability report in early 2020 in response to feedback from stockholders in connection with our continued proactive engagement efforts |

Ÿ | Increased focus on talent development - implemented Front Line Leadership Development program at manufacturing facilities to strength organizational performance through ethical, effective and sustainable leadership |

Ÿ | Continued proactive engagement with BlueGreen Alliance, environmental groups and others |

|

| | |

EXECUTIVE COMPENSATION | Ÿ | Approximately 75%Over 80% of CEO and Chief Operating Officer ("COO") target compensation is “at-risk”, with >50%>60% subject to stringent performance metrics |

Ÿ | Approximately 55% to 68%70% of the target compensation of the other named executive officers ("NEOs") is “at-risk”, with >50%35% to 50% subject to stringent performance metrics |

Ÿ | Compensation programs supported by best practices and aligned with our strategic objectives and stockholder interests |

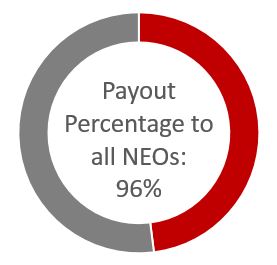

Ÿ | Continued stockholder support for NEO (84%executive compensation (approximately 96% approval in 2019) |

Ÿ | Incentive plans continue to require increasing levels of performance |

Ÿ | Revised weighting of the long-term incentive ("LTI") program performance metrics to increase total shareholder return ("TSR") from 30% to 60%2022) |

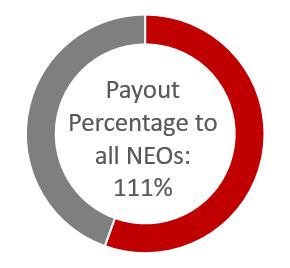

EXECUTIVE COMPENSATION HIGHLIGHTS

As notedOur incentive programs are designed to “pay for performance,” and it is expected that payouts may be impacted during difficult business/economic conditions. The compensation committee, based on our management's recommendation, did not make any adjustments to our existing incentive programs despite the numerous challenges we encountered in the letter from2022, including unprecedented supply chain disruptions, inflationary cost pressures and labor turnover, which negatively impacted our Chairmanfinancial performance and Lead Independent Director,resulted in no payout under our success over the years has been driven by2022 short-term incentive plan and no performance shares earned under our people, a highly focused and consistent strategy to drive steady continuous improvement and our pursuit of the following six key strategic initiatives that align our actions with our corporate values to ensure that our2020 – 2022 long-term success is driven by practices that are economically, environmentally and socially responsible:

|

| | | |

Ÿ | Advance our position as the supplier of choice | Ÿ | Enhance quality and depth of technical and managerial talent |

Ÿ | Achieve and sustain a position as a low cost producer | Ÿ | Sustain financial strength and flexibility |

Ÿ | Pursue profitable sales growth | Ÿ | Enhance our standing as a valued corporate citizen |

Each of these initiatives has been, and continues to be, reflected in our compensation structure. incentive plan.As described in further detail in the “Executive Compensation - Compensation Discussion and Analysis” section of this Proxy Statement, or CD&A, our 20192022 compensation structureprogram was developed and designed to:

ii

•align the interest of our named executive officers and stockholders by tying a significant portion of compensation to enhancing stockholder return;

•attract, motivate and retain highly experienced executives with significant industry experience vital to our short-term and long-term success, profitability and growth;

•deliver a mix of fixed and at-risk compensation with the portion of compensation at risk increasing with seniority;

•tie our executive compensation to our ability to pay and safety, quality, delivery, cost and individual performance directly linked to our strategic initiatives; and

•require increasing levels ofstrong financial performance as we continue to invest in our business.

In 2019,2022, the compensation of our named executive officers consisted primarily of the following components:

•a base salary (1) compensating each named executive officer based on the level and scope of responsibility, individual expertise and prior experience and (2) providing a fixed amount of cash compensation upon which our named executive officers can rely;

•a short-term annual cash incentive (1) payable only if our company achieved a certain adjusted earnings before interest, taxes, depreciation and amortization, or Adjusted EBITDA, performance level, which has continued to increase annually, as we continue to invest in our business, resulting in increasingly demanding performance required to realize the same or similar payouts year-over-year, (2) adjusted based on our (a) safety performance, (b) quality performance, (c) delivery performance, (d) cost performance, and (e) in exceptional and rare instances approved by our compensation committee, positive and negative adjustments to individual and groupawards based on individual, facility, and/or functional area performance, as well as performance against other strategic initiatives, and (3) capped at three2.5 times target; and

•an equity-based, long-term incentive designed to align compensation with the interests of our stockholders and to enhance retention of our named executive officers consisting of (1) restricted stock units with three-year cliff vesting and (2) performance shares, which vest, if at all, based on our performance against demanding underlying metrics over the applicable three-year performance period.

Because grants under our long-term incentive program are outstanding for three years, at any time we have three over-lapping long-term incentive programs outstanding and theoutstanding. The underlying metrics applicable to the performance shares can vary as our compensation committee assesses the effectiveness of our outstanding programs, metrics critical to our long-term success, feedback from our stockholders and compensation trends. The following table describes the performance share metrics (described more fully below) we used for our 2017-2019, 2018-20202020–2022, 2021– 2023 and 2019-20212022– 2024 long-term incentive programs:

|

| | | |

| Performance Share Metrics | 2017-2019 | 2018-2020 | 2019-2021 |

| Relative TSR | 40% | 30% | 60% |

| Total Controllable Cost | 40% | 40% | 40% |

| Economic Value Added ("EVA") | 20% | 30% | |

Our

| | | | | | |

Performance Share Metrics | | 2020-2022 | | 2021-2023 | | 2022-2024 |

Relative Total Shareholder Return ("TSR") | | 60% | | 60% | | 60% |

Total Controllable Cost | | 20% | | 20% | | |

Adjusted EBITDA Margin | | 20% | | 20% | | 40% |

The compensation committee, working with the compensation committee’sits independent compensation consultant, Meridian Compensation Partners, LLC (referred to herein as Meridian), reviews, evaluates and updates our compensation peer group, which includes companies in both similar and different industries, at least annually. For 2019, our2022, the compensation committee approved the 34-companya new 26-company peer group more fully described in our CD&A section withto account for the increased company size and scope resulting from our acquisition of Warrick. As of November 2021, the new custom peer group had (1) market capitalizationscapitalization ranging from $489approximately $696 million to approximately $11.6$12.9 billion and a median market capitalization of approximately $2.2$3.4 billion, and (2) trailing 12 months revenues ranging from $736 million$1.5 billion to approximately $3.7$6.8 billion and median revenue of approximately $1.7$3.4 billion. Our market capitalization and revenue, both as of December 31, 2019 and revenues for 20192022, were $1.8$1.2 billion and $1.5$3.4 billion, respectively. Due to the differences in size among the companies in our peer group, Meridian uses a regression analysis to adjust survey data results based on our revenue as compared to the revenue of other companies in our peer group.

The table below summarizes the performance metrics under our 20192022 short-term incentive and 2019-20212022 –2024 long-term incentive plans:

|

| | | | |

Incentive Program | Performance Metric | Weighting | Modifier* | Impact on Multiplier |

Short-Term Incentive Plan | Adjusted EBITDA | 100% | Safety (TCIR & LCIR) | +/- 10% |

|

|

| Quality | +/- 10% |

|

|

| Delivery | +/- 10% |

|

|

| Cost | +/- 20%10% |

|

|

| Individual | +/- 100%25% |

Long-Term Incentive Plan | Total Controllable CostRelative TSR | 40%60% |

|

|

| TSRAdjusted EBITDA Margin | 60%40% |

|

|

* The safety modifier is measured using our total case incident rate ("TCIR") and lost-time case incident rate ("LCIR"), the quality modifier is measured using our no-fault claim rate, the delivery modifier is measured by our on-time delivery rate, and the cost modifier is measured by our manufacturing efficiency. As noted, the individual modifier is discretionary and, with respect to our executive officers, only used in exceptional and rare instances approved by the compensation committee.

committee based on actual performance, including individual, facility and/or functional area performance, as well as performance against other strategic initiatives. Individual awards may be adjusted up or down 25% in recognition of exceptional performance, including individual, facility, and/or functional area performance.

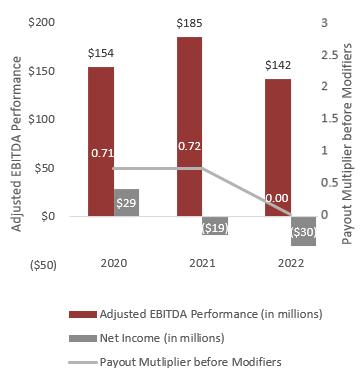

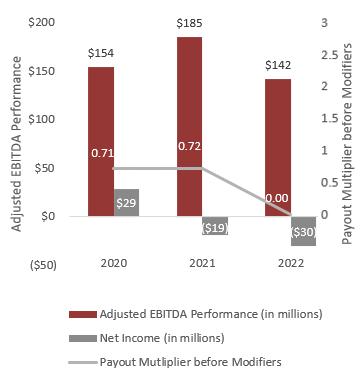

The following summarizes our performance against the metrics under our 20192022 short-term incentive and 2017-20192020- 2022 long-term incentive plans:

2019

2022 Short-Term Incentive

_______________

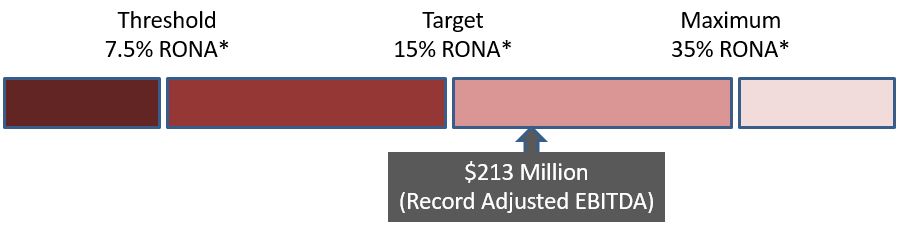

* The targets are based on the Adjusted EBITDA required to achieve the designated return on net assets (excluding cash) using our adjusted pre-tax operating income. As noted, our increasing net assets and depreciation raise the year-over-year Adjusted EBITDA targets. While we achieved strong quality performance in 2019, our safety, on-time delivery and cost performance lagged and did not meet our demanding expectations and requirements, resulting in +10%, -1%, -12% and -25% modifiers, respectively, and an overall reduction of our Adjusted EBITDA multiplier of 1.24 to a final multiplier of 0.96.

FEATURES |

| | |

FEATURES |

Ÿ | Pay for performance |

Ÿ | Adjusted EBITDA target determined based on return on net assets (excluding cash) using our adjusted pre-tax operating income |

Ÿ | Modifiers for safety, quality, delivery and cost performance establishing a strong linkage to strategic non-financial results |

Ÿ | In exceptional and rare instances approved by ourthe compensation committee, individual adjustment up to plus or minus 100%25% based on actual performance, including individual, facility and/or functional area performance, as well as performance against other strategic initiatives |

Ÿ | No payout unless we: |

| (1) | achieve the threshold Adjusted EBITDA goal of a 7.5% return on our adjusted net assetsgoal; and |

| (2) | generate positive adjusted net income |

Ÿ | Maximum payout capped at three2.5 times the target |

Ÿ | Rigorous financial performance goals - target increases with investments and increasingly higher net assets and depreciation |

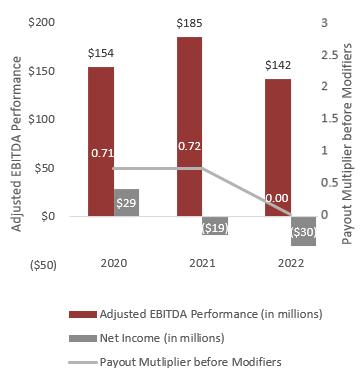

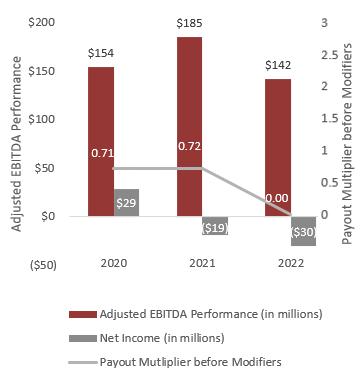

As previously discussed, we did not achieve the threshold Adjusted EBITDA performance required for a payout under our 2022 STI program. While our end markets remained strong in 2022 and commercial aerospace demand continue to strengthen, our Adjusted EBITDA performance for 2022 was lower than our Adjusted EBITDA during the prior two years due to the negative impact of a number of factors, including (i) the continuation of our supply chain challenges, such as the continuing impact of the declaration of force majeure by Warrick’s primary magnesium supplier and ultimately the cessation of all magnesium deliveries from that supplier that led to our declaration of force majeure at Warrick, (ii) molten metal supply issues that negatively impacted Warrick, (iii) the inflationary environment and significant corresponding increases in costs, (iv) a planned outage at our Trentwood rolling mill in Spokane, Washington, and (v) a challenging labor market contributing to inefficiencies and historically high turnover rates. As a result, no payouts were earned under our 2022 STI program.

iv

Annual Performance Award Payouts under Short-Term Incentive Plans for our Named Executive Officers

|

| | |

The Adjusted EBITDA targets under our short- term2022 short-term incentive plan reflect the Adjusted EBITDA required to achieve 7.5%6%, 15%11% and 35%30% returns on our adjusted net assets (excluding cash) based on adjusted pre-tax operating income at the threshold, target and maximum payout levels. As we have continuedIn 2021, our company size increased due to investour acquisition of Warrick, resulting in our business our net assets and depreciation have continued to grow and, as a result, the Adjusted EBITDA targets have continued to17.5% increase each year. To that end,of our Adjusted EBITDA performance at the target levelfor 2021 compared to 2020. In 2022, our Adjusted EBITDA target was again increased 12% from 2018 to 2019. | | |

| |

| by another 10.6%.

The table on the right illustrates our annual Adjusted EBITDA performance multiplier for the last three years under our short-term incentive plans before the application of modifiers. See Appendix A to this Proxy Statement for reconciliations of GAAP to non-GAAP measures.

The final multipliers under our short-term incentive plan, after the application of modifiers (where applicable) for 2020, 2021, and 2022 were 0.51x, 0.65x and 0.00x, respectively. The final multipliers for the 2020 and 2021 short-term incentive plans reflect the impact of our performance against demanding modifiers in a very challenging business environment. |

|

|

The Adjusted EBITDA Multiplier under our 2019 Short-Term Incentive Plan is the lowest in the last three years despite our record Adjusted EBITDA performance due to the impact of our additional investments and increasing depreciation which increase our Adjusted EBITDA targets. After the application of modifiers, the final multipliers under our short-term incentive plan for 2017, 2018, and 2019 were 1.51x, 1.18x and 0.96x, respectively, each reflecting the impact of our performance against demanding modifiers.

2017-2019

2020- 2022 Long-Term Incentive

|

| | |

Relative TSR* | | FEATURES |

Controllable Cost** | |

EVA*** | |

_____________* Relative TSR is against companies comprising the S&P 600 SmallCap Materials Sector Index.

** There was no payout under the EVA performance metric as we did not achieve threshold EVA performance.

|

| | |

FEATURES |

Ÿ | Three-year performance period (2017-2019)(2020-2022) |

Ÿ | Includes retention features by utilizing time-vested restricted stock units |

Ÿ | Pay for performance by utilizing performance shares subject to demanding metrics |

Ÿ | Performance metrics: |

| (1) | 40%20% based on Adjusted EBITDA margin |

| (2) | 20% based on controllable cost |

| (2)(3) | 40%60% based on relative TSR |

| (3) | 20% based on EVA |

Ÿ | Payout for relative TSR performance is capped at target if TSR is negative |

Ÿ | Payout at target for controllable cost performance only if we offset inflation |

Ÿ | No windfall upon a change in control for performance shares - only shares earned based on performance through the date of the change in control will vest |

We did not achieve the performance thresholds for Adjusted EBITDA margin, controllable cost or relative TSR under the 2020-2022 long-term incentive plan. As discussed in more detail below, for the 2020-2022 performance period, the impact of the COVID-19 pandemic and continued operational challenges significantly and negatively impacted our ability to achieve the required level of performance for each of the performance metrics under the 2020-2022 long-term incentive plan. Accordingly, no performance shares were earned under the 2020-2022 long-term incentive plan.

v

Annual Performance Award Payouts under Long-Term Incentive Plans

The table below reflects our annual performance award payouts for the last three years under our completed long-term incentive plans.

|

| | | | | | | | | | | | |

| Metric | 2015-2017 Plan | 2016-2018 Plan | 2017-2019 Plan |

| Weighting | Multiplier | Weighted Multiplier | Weighting | Multiplier | Weighted Multiplier | Weighting | Multiplier | Weighted Multiplier |

| TSR | 100 | % | 1.7x | 1.7x | 60 | % | 0.9x | 0.5x | 40 | % | 1.9x | 0.8x |

| Cost | | | | 40 | % | 1.18x | 0.5x | 40 | % | 0.9x | 0.4x |

| EVA | | | | | | | 20 | % | 0.0x | 0.0x |

| Plan Multiplier | | | 1.7x | | | 1.0x | | | 1.1x |

| | | | | | | | | | | | | | | | |

| | 2018-2020 Plan | 2019-2021 Plan | 2020-2022 Plan |

Metric | | Weighting | | Multiplier | Weighted

Multiplier | Weighting | | Multiplier | Weighted Multiplier | Weighting | | Multiplier | Weighted Multiplier |

Relative TSR | | | 30 | % | 1.24x | 0.37x | | 60 | % | 0.52x | 0.31x | | 60 | % | 0.00x | 0.00x |

Cost | | | 40 | % | 0.04x | 0.02x | | 40 | % | 0.00x | 0.00x | | 20 | % | 0.00x | 0.00x |

EVA | | | 30 | % | 0.00x | 0.00x | | 0 | % | 0.00x | 0.00x | | 0 | % | 0.00x | 0.00x |

Adjusted EBITDA Margin | | | 0 | % | 0.00x | 0.00x | | 0 | % | 0.00x | 0.00x | | 20 | % | 0.00x | 0.00x |

Plan Multiplier | | | | | 0.39x | | | | 0.31x | | | | 0.00x |

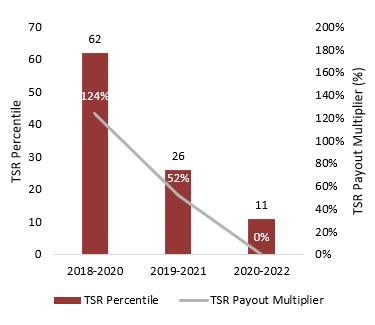

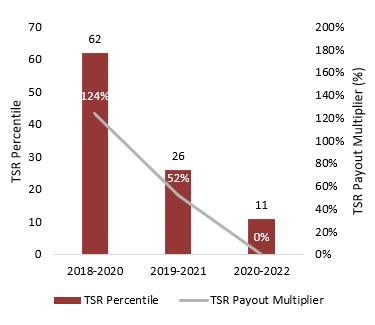

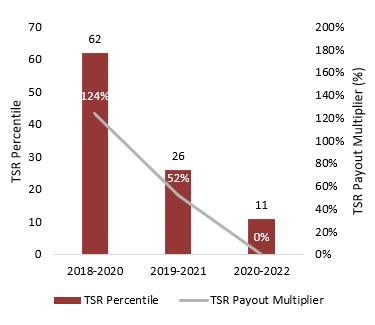

Performance Share Award Payouts Based on Relative TSR

For our 2020-2022 long-term incentive compensation program, 60% of the performance shares issued to our named executive officers were subject to our TSR performance over the applicable three-year performance period compared to the TSR of the other companies comprising the S&P SmallCap 600 Materials and S&P MidCap 400 Materials Indices.

In considering constituents for the S&P SmallCap 600 Materials and S&P MidCap 400 Materials Indices, S&P Dow Jones Indices currently looks for companies (1) with market capitalization of between $750 million and $4.6 billion and between $4.6 billion and $12.7 billion, respectively, (2) meeting certain float requirements, (3) with a U.S. domicile, (4) required to file Securities and Exchange Commission ("SEC") annual reports, and (5) listed on a major U.S. exchange, among other factors. The beginning and ending stock prices used to determine our TSR are calculated using the 20-trading day average preceding the beginning and end of the performance period.

For the 2020 to 2022 performance period, the factors that impacted our Adjusted EBITDA and financial performance also negatively impacted our TSR performance. As a result, we did not achieve the threshold TSR percentile ranking required for a payout and no performance shares were earned under the 2020-2022 relative TSR metric.

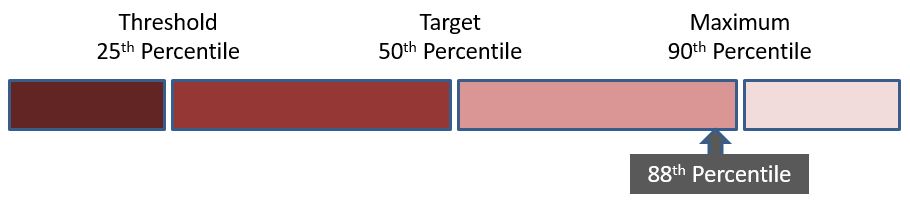

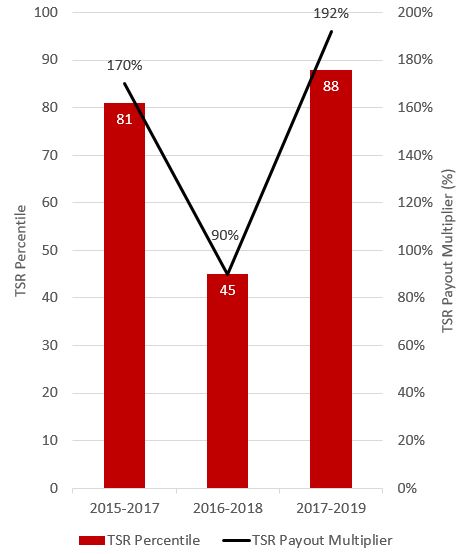

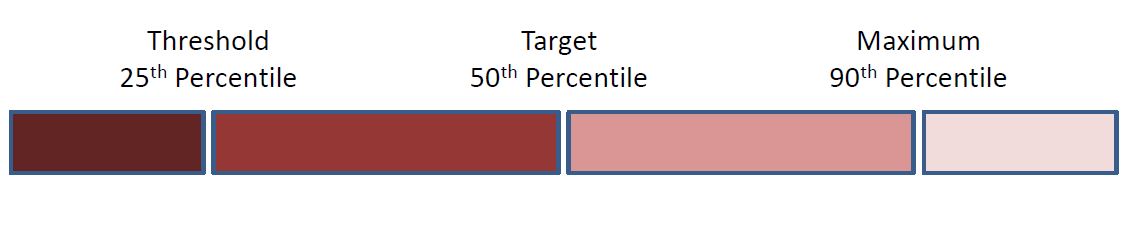

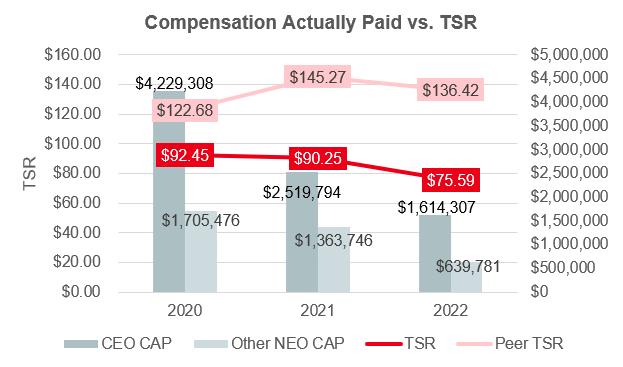

The chart below illustrates the performance share award payouts based on our relative TSR performance for the 2015-2017, 2016-20182018-2020, 2019-2021 and 2017-20192020- 2022 long-term incentive programs:

|

| | | | |

| Performance shares earned, if any, are determined by our TSR over the applicable three year performance period compared to the TSR of the other companies comprising the S&P 600 SmallCap Materials Sector Index. In considering constituents for the S&P SmallCap 600, S&P Dow Jones Indices looks for companies (1) with market capitalizations of between $450 million and $2.1 billion, (2) meeting certain float requirements, (3) with a U.S. domicile, (4) required to file Securities and Exchange Commission ("SEC") annual reports, and (5) listed on a major U.S. exchange, among other factors. |

| | | |

The beginning and ending stock prices used to determine our TSR are calculated using the 20-trading day average preceding the beginning and end of the performance period. |

| | | |

The performance share multiplier is determined by using straight line interpolation based on our TSR percentile ranking within our comparison group based on the table to the right: | Percentile Ranking | | Multiplierbelow: |

< 25th

| Percentile Ranking | 0.0x

| Multiplier |

25th

| < 25th | 0.5x

| 0.0x |

50th

| 25th | 1.0x

| 0.5x |

75th

| 50th | 1.5x

| 1.0x |

≥ 90th

| 75th | 2.0x

| 1.5x |

|

|

|

|

|

|

|

|

|

|

|

|

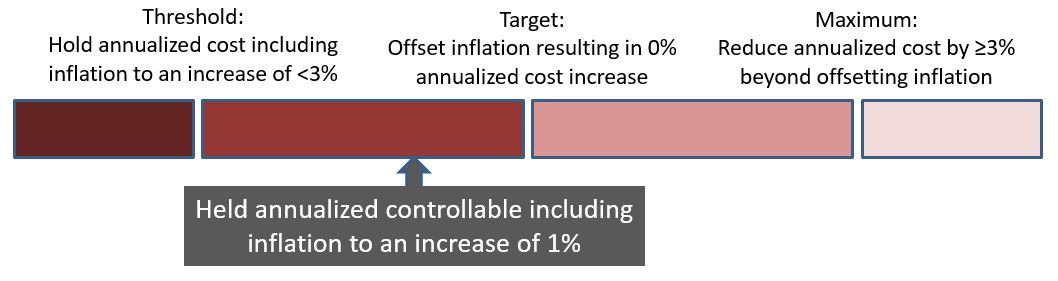

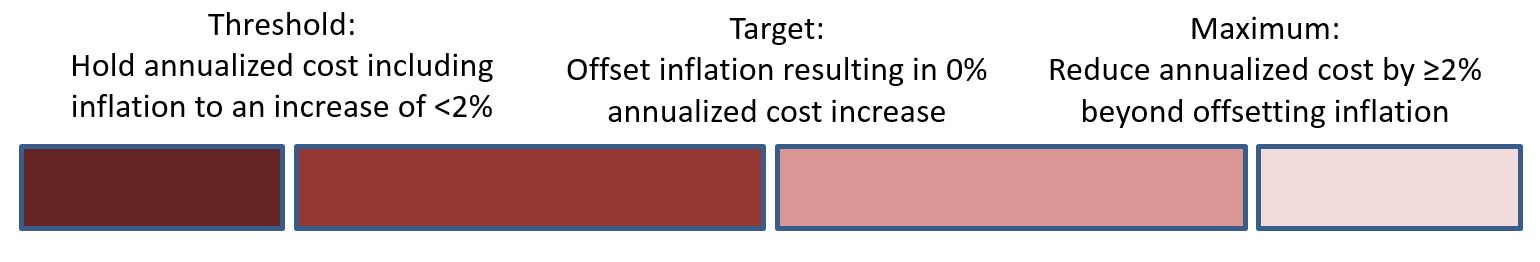

Performance Share Award Payout Based on Controllable Cost

Achieving and sustaining a position as a low cost producer is one of our six key strategic initiatives. CostsFor our 2017-20192020-2022 long-term incentive compensation program, 40%20% of the performance shares issued to our named executive officers were subject to a controllable cost performance metric that required our company to reduce controllable costs to offset underlying inflation over the three-year performance period to achieve the target payout of performance shares subject to the controllable cost metric. A 9% reduction of controllable costs after offsetting underlying inflation over the same three-year period would result in payout of performance shares equal to two times target and an increase of controllable costs of 9% or more would result in no payout of performance shares subject to the controllable cost metric.

Controllable costs are generally defined as our variable conversion costs which adjust with our product volume and mix plus corporate and plant overhead. Controllable costs also (1) include benefits because we believe that management is required to take actions to influence benefit costs over the performance period and (2) exclude, among other things, major maintenance, research and development and enterprise resource planning costs to ensure that we continue to invest in the future of our company.

A 6% reduction ofvi

controllable costs after offsetting underlying inflation over the same three-year period would result in payout of performance shares equal to two times target and an increase of controllable costs of 6% or more over the three-year performance period would result in no payout of performance shares subject to the controllable cost metric.

For the 2020-2022 performance period, our controllable cost performance was significantly impacted by challenging business conditions, the impact of the COVID-19 pandemic on our end markets, the inflationary environment in 2022, supply chain challenges and corresponding cost increases and a challenging labor environment. As a result, we did not reach our threshold controllable cost performance by offsetting the underlying inflation during the performance period and no performance shares subject to the controllable cost metric were earned.

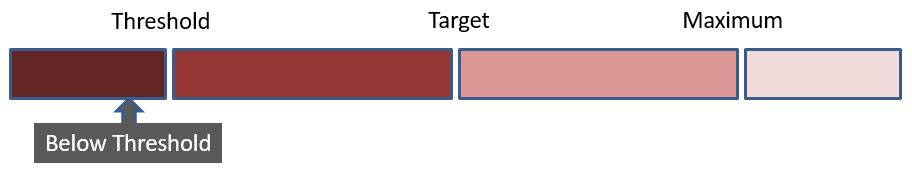

Performance Share Award Payout Based on EVA

Adjusted EBITDA MarginFor our 2020-2022 long-term incentive compensation program, 20% of the performance shares grantedissued to our named executive officers were subject to an Adjusted EBITDA margin performance metric, calculated by our Adjusted EBITDA as a percentage of conversion revenue over the three-year performance period. Our conversion revenue is calculated as our net sales less the hedged cost of alloyed metals.

With respect to the 2020-2022 performance shares, the same significant negative factors that impacted our Adjusted EBITDA and cost performance also impacted our Adjusted EBITDA margin performance. As a result, we did not achieve the threshold Adjusted EBITDA margin required for a payout and no performance shares were earned under our 2017-2019the 2020-2022 long-term incentive plan, the payout is determined based on EVA performance, calculated using our adjusted pre-tax operating income in excess of an amount equal to 15% of our net assets.

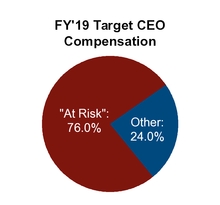

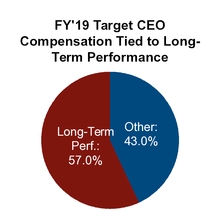

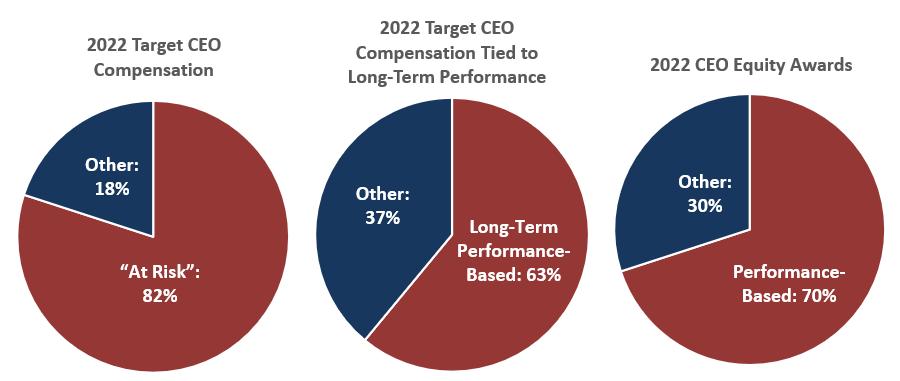

2019plan.2022 Total CEO Compensation

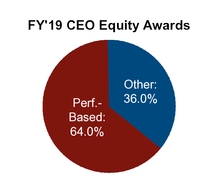

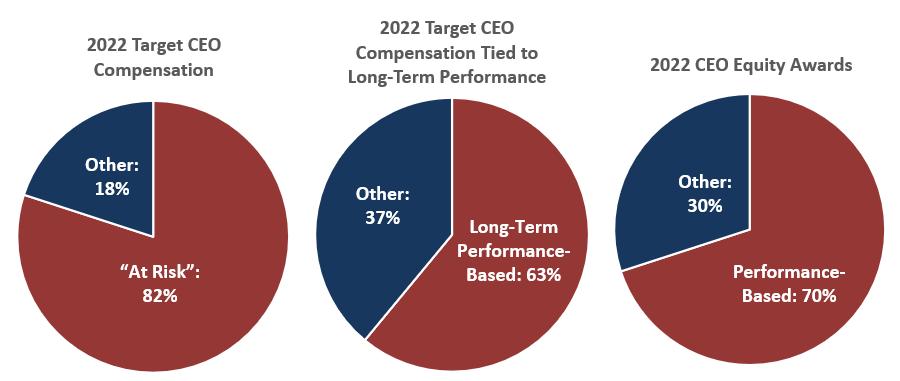

As previously noted, the mix of our CEO’s total target compensation is heavily weighted toward performance-based compensation with more than 75%80% of the total target compensation being at-risk (short- and long-term compensation), 57%more than 60% of the total target compensation being long-term, and 64%70% of the long-term target being allocated to performance shares.

For 2019, the

The market pay analysis performed by Meridian at the end of 2022 reflected that the total target compensation of our CEO for 2022 was 5%23% below the median of our compensation peer group and that our CEO’s (1) base salary was approximately 8% above9% below the median base salary, (2) short-term incentive target was approximately 28%22% below the median and (3) long-term incentive target was approximately 6% above19% below the median. Regressed Equilar Executive Compensation Survey data receivedThe payout to our CEO under our incentive program was further impacted by the challenging business conditions, including supply chain disruptions. As previously discussed, although the payouts under our compensation committee reflected similar comparisons. Using that information,incentive programs, including the payouts to our CEO, were significantly impacted by the previously described severe business conditions and operational challenges, based on management’s recommendation, the compensation committee did not increase our CEO’s 2019 base salary and, instead allocated a total increase in his 2019 total target compensation of 3% to his short- and long-term incentive compensation targets to bring his short-term incentive closer to the median of our compensation peer group, continue to more heavily allocate his total target compensation to his long-term incentive compensation and continue to increase his at-risk compensation and drive the alignment reflected in our compensation philosophy.

As reflected in more detail in the Summary Compensation Table in the CD&A section of this Proxy Statement, in 2019, despite excellent performance and record shipments, record value added revenue, record adjusted earnings per share, record adjusted net income and near record Adjusted EBITDA, the total compensation of our CEO decreased by 2.9% from his 2018 total compensation and decreased by 8.3% from his 2017 total compensation. The year-over-year decreases in total compensation resulted from the increasingly demanding performance metrics in both our short-term and long-term incentive compensation plans as we continue to invest in our business, grow our net assets, increase our depreciation, increase the financial returns required to achieve target performance levels for our financial metrics and increase the level of performance required by our performance metrics and modifiers.

In summary, our incentive compensation programs are designed to demand continuous improvement in our year-over-year results for our CEO and other named executive officers to realize the same year-over-year financial benefit under our incentive compensation plans. We believe that an incentive plan design emphasizing the importance of successful execution of each of our six key strategic initiatives is importantmake any adjustments to our long-term success and alignsexisting incentive programs or the interests of our CEO and other named executive officers with our success and our stockholders.

HEALTH AND SAFETY OF OUR EMPLOYEES

This Proxy Statement relates to our 2019 performance and compensation, neither of which were effected by the COVID-19 pandemic. Although the COVID-19 pandemic could significantly impact 2020 financial results and compensation outcomes, we have initiated the following actions to address the effect of the COVID-19 pandemic on our employees and business operations:

•Monitoring and implementing local, state and federal guidelines;

following the guidelines issued by the Centers for Disease Control and Prevention to mitigate the risk of exposure to COVID-19;

•Implementing additional health and safety protocols for contractors and service providers;

•Developing contingency plans to respond to employees experiencing symptoms;

•Increasing daily communications with plant managers and business leaders; and

•Working with benefits providers and other resources to support our employee.

underlying payouts.

vii

Kaiser Aluminum Corporation

27422 Portola Parkway,1550 West McEwen Drive, Suite 200

Foothill Ranch, CA 92610-2831

500Franklin, Tennessee 37067

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held Onon June 10, 2020

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be held on June 10, 2020:7, 2023: The Proxy Statementand our Annual Report to Stockholders are available at www.envisionreports.com/kalu.

GENERAL QUESTIONS AND ANSWERS

| | |

Q: | Why did I receive a notice aboutWhen is the company’s proxy materials? |

| Proxy Statement being sent to stockholders and what is its purpose? |

A: | You received a Notice of Internet Availability ofThis Proxy Materials (the “Notice”) because you were a holder of record or beneficial owner of shares of common stock of Kaiser Aluminum Corporation as of the close of business on April 17, 2020. We began distributing the Notice and accompanying proxy materialsStatement is first being sent to our stockholders on or about April 29, 2020. OurMay 5, 2023 at the direction of our board of directors is soliciting your proxyin order to vote at the 2020 Annual Meeting of Stockholders (the “Annual Meeting”). Our board of directors has made our proxy materials, including the Notice, this Proxy Statement, our Annual Report and proxy card, available to you on the internet, or upon your request, has delivered printed proxy materials to you in connection with the solicitation ofsolicit proxies for our use at the Annual Meeting. Our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (the “Annual Report”), along with this Proxy Statement and all other relevant corporate governance materials, are also available at www.kaiseraluminum.com. |

| |

Q: | Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of the proxy materials themselves, and how can I get the materials? |

| |

A: | In accordance with rules adopted by the Securities and Exchange Commission, we have elected to furnish proxy materials, including this Proxy Statement and our Annual Report, to our stockholders by providing access to such documents on the internet instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice, which was mailed to most of our stockholders, will instruct you as to how you may access and review all of the proxy materials on the internet. The Notice also instructs you as to how you may submit your proxy on the internet. If you would like to receive a paper copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice |

| |

Q: | When is the Annual Meeting and where will it be held? |

| |

A: | The Annual Meeting will be held on Wednesday, June 10, 2020,7, 2023, at 9:00 a.m., local time,Central Time, at our corporate office, located at 27422 Portola Parkway,1550 West McEwen Drive, Suite 200, Foothill Ranch, California 92610. |

As part of our contingency planning regarding novel coronavirus (COVID-19), we are preparing for the possibility that the date, time or location of the Annual Meeting may be changed or that the Annual Meeting may be held by means of remote communication (sometimes referred to as a "virtual" meeting). If we take this step, we will announce the decision to do so in advance through a press release and public filing with the Securities and Exchange Commission, and details will be available at www.kaiseraluminum.com.

| 500, Franklin, Tennessee 37067. |

Q: | Who may attend the Annual Meeting? |

| |

A: | All of our stockholders of record may attend the Annual Meeting. |

| |

Q: | Who is entitled to vote? |

| |

A: | Stockholders as of the close of business on April 17, 202012, 2023 are entitled to vote at the Annual Meeting. Each share of our common stock is entitled to one vote. |

The election of three members to our board of directors to serve until our 2023 annual meeting of stockholders;

The approval, on a non-binding, advisory basis, of the compensation of our named executive officers as disclosed in this Proxy Statement;

The ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2020; and

Such other business as may properly come before the Annual Meeting or any adjournments.

| |

Q:

| | the election of four members to our board of directors to serve until our 2026 annual meeting of stockholders; |

| • | the approval, on a non-binding, advisory basis, of the compensation of our named executive officers as disclosed in this Proxy Statement; |

| • | The recommendation, on a non-binding, advisory basis, as to the frequency of future advisory votes on the compensation of our named executive officers; |

| • | the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2023; and |

| • | such other business as may properly come before the Annual Meeting or any adjournments. |

Q: | How does the board of directors recommend that I vote? |

| |